Our history

Our history built the foundation on what makes up BGC Liquidez today.

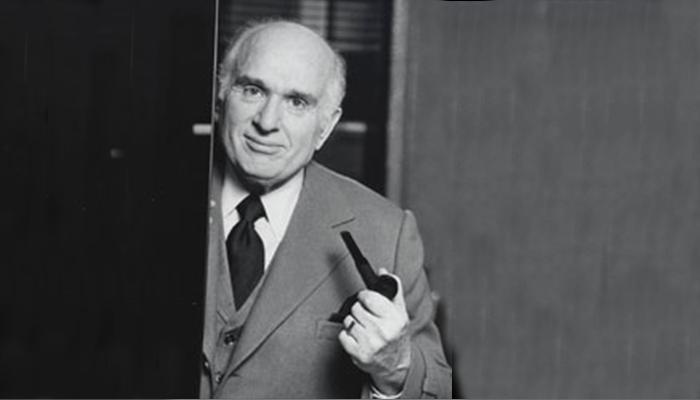

In 1945, B. Gerald Cantor founded B. G. Cantor & Company, a securities company. Two years later, he became a founding partner of Cantor, Fitzgerald & Company, adding the name of his other partner, John Fitzgerald.

Since its founding in 1945, Cantor Fitzgerald has grown and evolved into a global investment and brokerage bank.

Liquidez DTVM founded in Rio de Janeiro.

Cantor continues to build its relationships and harness its expertise on both its inter-dealer fixed income and institutional equities businesses, eventually expanding by opening offices in London.

Liquidez DTVM opens São Paulo office.

Howard W. Lutnick is named President and steers Cantor towards further technological innovation.

eSpeed, Cantor Fitzgerald’s fully eletronic trading platform, is launched

eSpeed, Cantor Fiztgerald Division becomes publicaly traded

Cantor Fitzgerald loses 658 of its 960 New York employees in the 9/11 World Trade Center attacks

Cantor Fitzgerald and its affiliates raise over $5 million on its 1st anual Charity Day

Cantor Fitzgerald separates out its brokerage business to create BGC Partners.

- BGC merges with eSpeed.

- Liquidez is awarded BM&F BOVESPA Execution Broker Seal.

BGC and Speed merges, creating BGC Partners, Inc, one of the world’s leading inter-dealer brokers

In 2009,

- BGC continues its expansion strategy and, after acquiring companies in Europe and Asia, turns its attention to Latin America, finalizing its acquisition of Brazilian brokerage company Liquidez.

- In September, BGC Partners raises over $10 million for charity on its Fifth Annual Global Charity Day, bringing the total over 4 years to more than $33 million.

- Ernst and Young names Howard W. Lutnick, Chairman and CEO of BGC Partners, winner of its U.S. Entrepreneur of the Year award.

- BGC Liquidez starts BOVESPA trading.

BGC Partners enters real estate brokerage Market and acquires Newmark Knight Frank, a leading comercial real state services firm.

BGC sells Speed fo Nasdaq for U$ 1.234 Billion

BGC acquires control of GFI Group In for $ 750 million and subsequently sells its Trayport business for $650 million

BGC Liquidez obtained from B3 the Nonresident Investor Broker in 2017

GFI announces IPO

NGKF separates its business from BGC and opens its capital and becomes listed on the NY Stock Exchange

BGC Liquidez obtained the new certificate of the B3, the “Programa de Qualificação Operacional” (PQO) Seal, which replaced the “Execution Broker” and “Nonresident Investor Broker” seals, acquired in 2007 and 2017 respectively.

BGC Liquidez also obtains another certificate from B3, the “Certifica” Seal